Overview

Summary

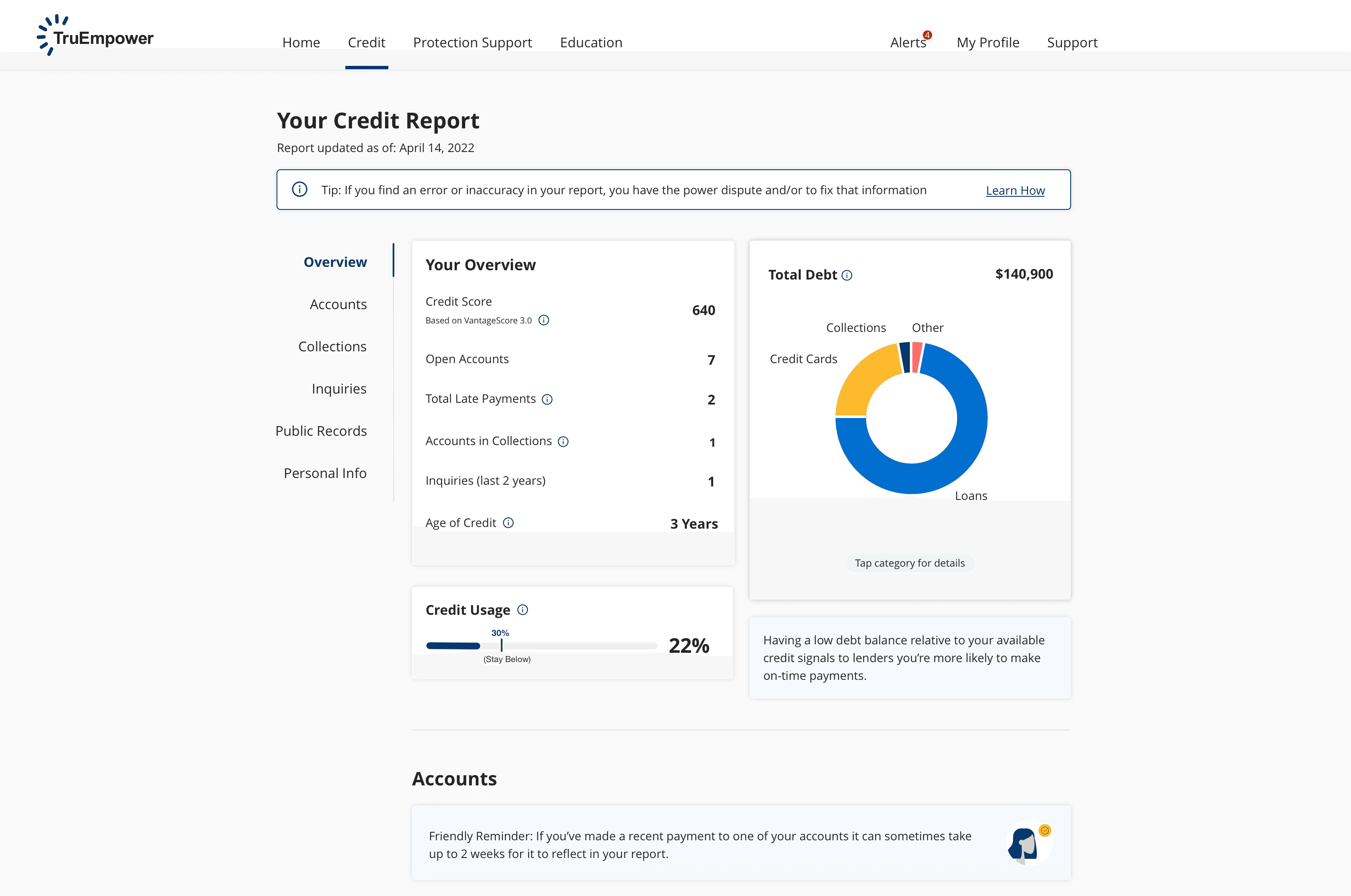

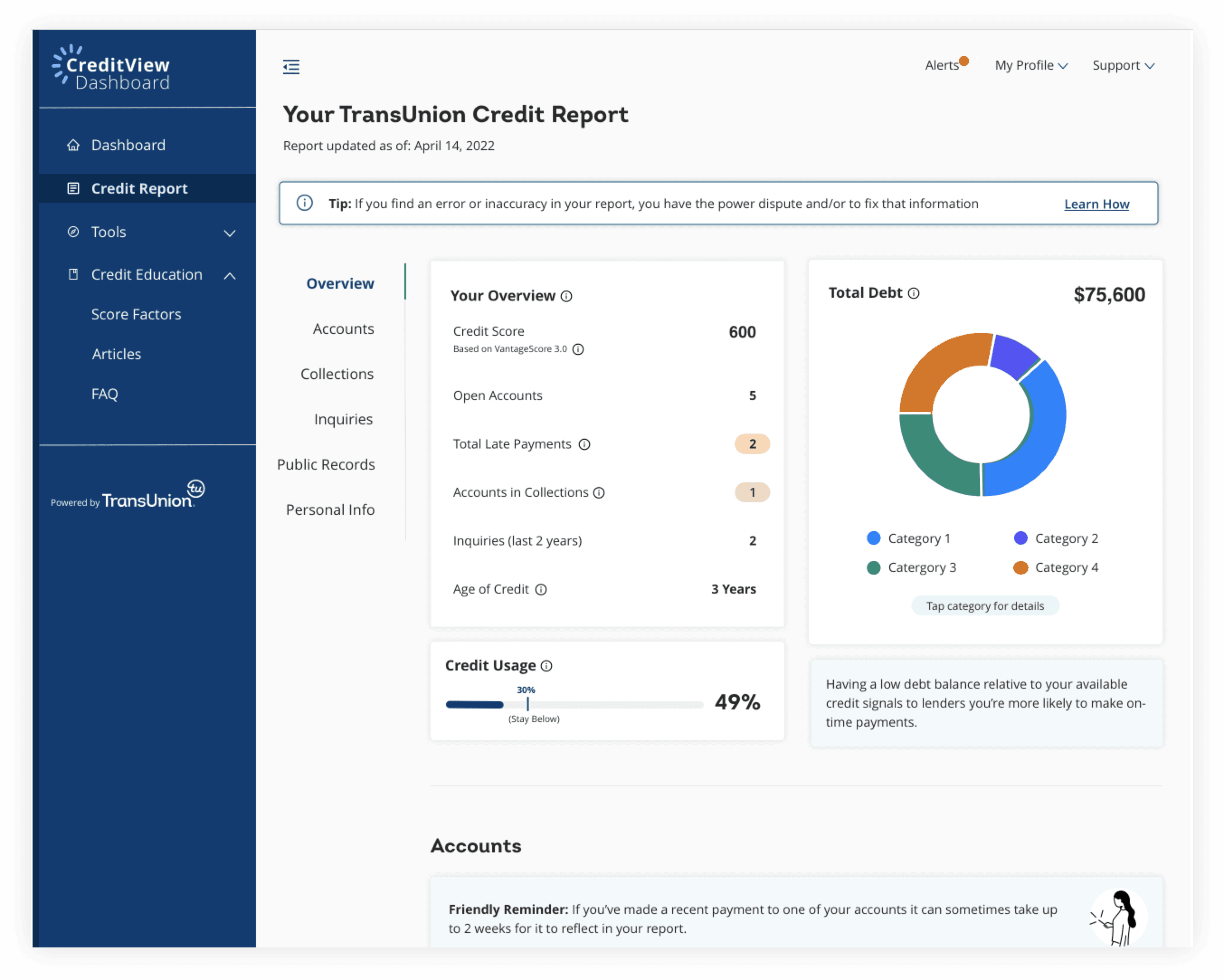

To enhance the TruEmpower product, we aimed to introduce credit report functionality, aligning with our partners' vision of providing a comprehensive credit monitoring experience. This was an enhancement to the existing product.

Results

27% surge in adoption within partner product.

Customer utilization of other parts of the site increased:

Credit Score Simulator had an 8% increase in use.

Credit Compass Goal Saving experienced a 12% boost.

6 new partners onboarded.

Projected to serve over 30 million users by the end of 2022.

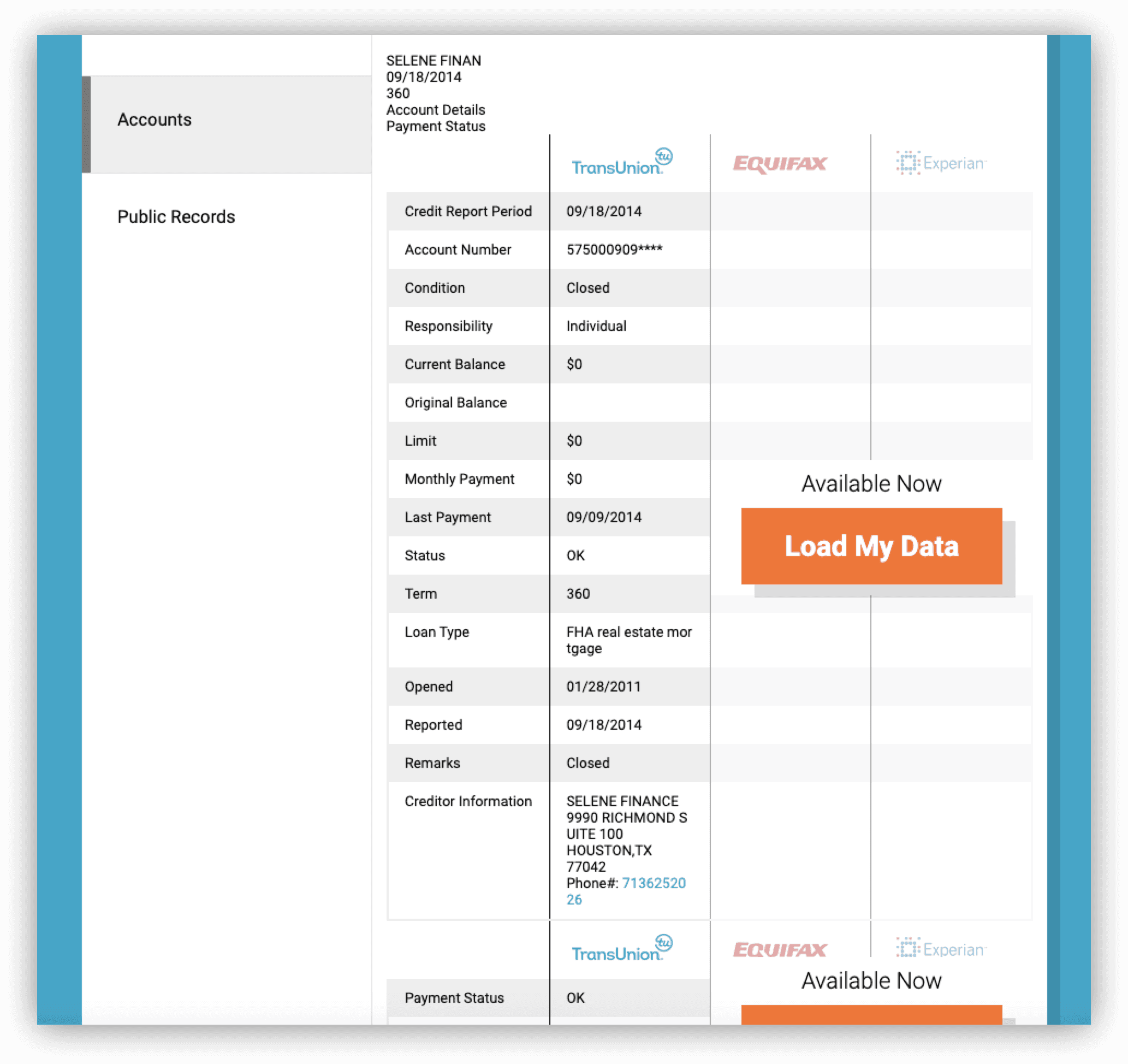

Framing the problem

The absence of a credit report feature in our white-label product posed a significant challenge. Our partners and their consumers highlighted this as a crucial missing function. The existing credit report provided by an adjacent product within the TransUnion portfolio exhibited poor design and accessibility issues, exacerbating the problem. Addressing these shortcomings became imperative to enhance the overall user experience and ensure the product's alignment with industry standards.

My contribution

UX design

UI Design

The team

3 × product manager

2 × product designer

10 × engineers

Process

Approach 🧭

Overall, our strategy followed design thinking's method of empathize, ideate, prototype, and test. We conducted research that led to insights, understood requirements from the product, and had in-depth meetings with development, who were also building the UI library alongside this feature.

Challenges 🚨

I identified gaps in our system's components and styles, simplifying complexity by integrating existing patterns into wireframes, supported by detailed specifications for development handoff.

We discovered that our credit API did not match expectations and required significant updating in order to service the front end design. Together with my Senior Designer and the Credit SME, we collaborated to diligently map available data sources to inform the design process.

Solution 💚

We created a fully accessible and useful credit report. It was reduced in scope from what my Senior Designer and I designed initially envisioned because of limitations in capacity but was effective in conveying the information to the user in an easily readable fashion.

Some features that were included and followed our "always guiding" mentality were: guiding content for basic credit situations (like credit lock or new inquiry), debt and credit utilization visualizations, and an enhanced credit summary.