Overview

Summary

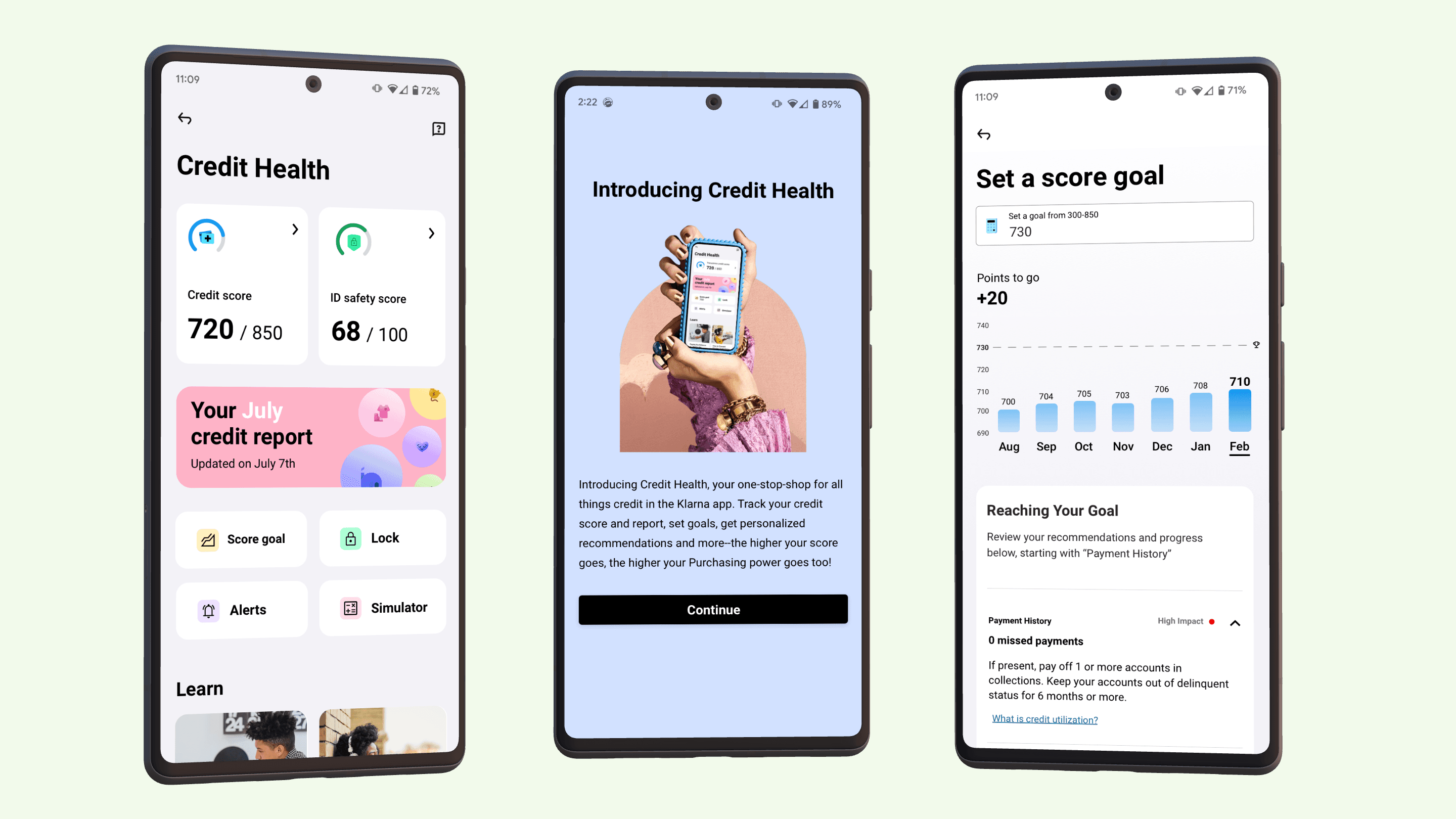

The project aimed to integrate credit monitoring features into the Klarna app to provide users with insights into their credit health while seamlessly aligning with Klarna's existing design language and user experience. As the Product Designer, I led the effort to conceptualize and design the integration of credit monitoring features into the Klarna app.

Results

Unfortunately, despite positive feedback from the team, the concept did not progress to implementation. This outcome highlights the importance of continual exploration and collaboration to deliver impactful solutions.

Framing the problem

Klarna, a leading buy-now-pay-later platform, recognized the importance of offering credit monitoring services to its users. However, integrating these features into the Klarna app posed challenges, including account access issues and potential revenue loss.

My contribution

UX design

UI Design

The team

2 - Sales representatives

1 - Design Manager

Process

Approach 🧭

To tackle the problem, I leveraged a user-centered design approach, conducting competitive analysis and stakeholder interviews to understand requirements and constraints. Prototyping and iterative design were key components of the approach, allowing us to refine designs based on feedback and technical feasibility.

Challenges 🚨

Unexpected challenges included aligning the features with Klarna's existing user flows, technical limitations regarding real-time data updates, and ensuring compliance with regulatory standards while maintaining a user-friendly interface.

Solution 💚

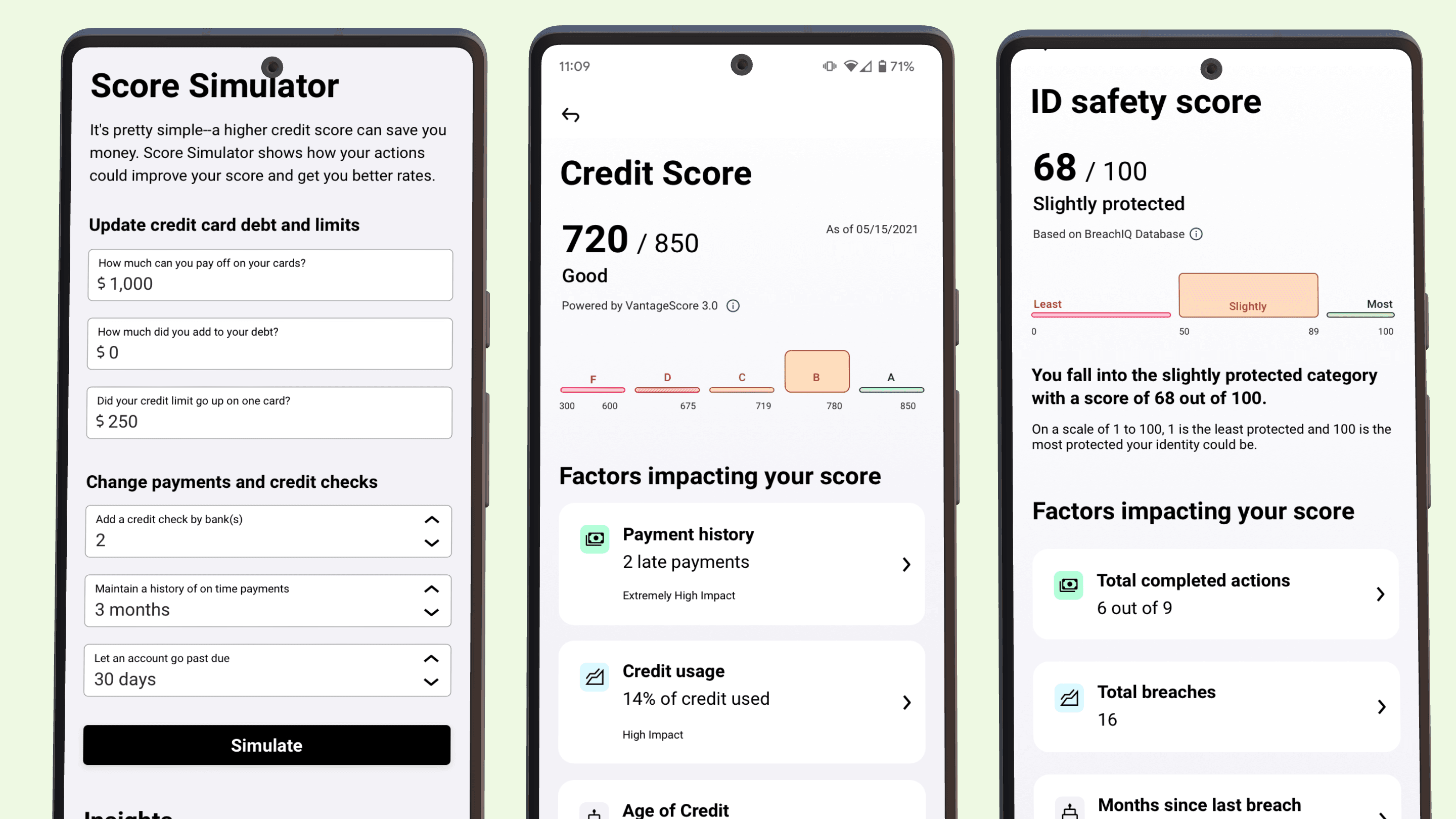

In addition to integrating a credit dashboard, I proposed and implemented innovative solutions to enhance the user experience further:

Credit Insights Section:

Utilizing existing features, I introduced a Credit Insights section within the payment calculator. This section contextualized credit information, providing users with valuable insights to better understand their credit health.Credit Missions:

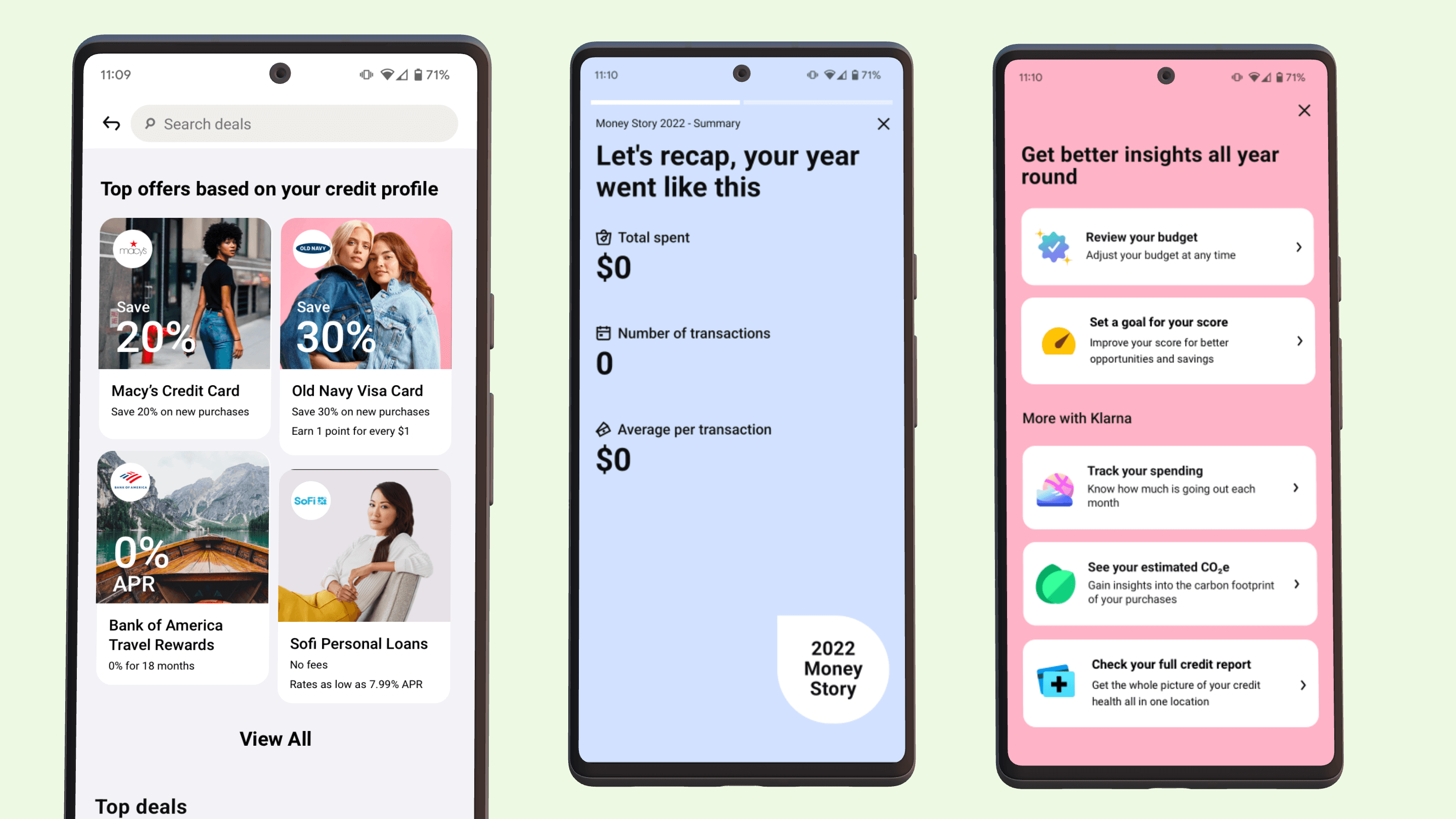

Leveraging Klarna's rewards system, I introduced credit missions that users could complete to earn points. These missions incentivized users to actively engage with their credit situation, fostering financial awareness and responsibility.Customized Offers:

Leveraging our credit bureau API, I proposed the addition of customized offers based on users' credit profiles. This personalized approach not only enhances the user experience by providing tailored recommendations but also increases conversion rates by presenting offers that are relevant and likely to be accepted by the user.Credit Progress Tracking:

Taking inspiration from platforms like Spotify's "wrapped," I proposed the development of a feature that visualizes users' progress in the credit space over time. This feature would provide users with a comprehensive overview of their credit journey, highlighting achievements and milestones to encourage continued engagement and financial responsibility.